Follow us on:

|

![The 755 page Estimates of National Expenditure sets out in detail what national departments plan to do and what their budget allocations are [Image: TBP]](http://thebricspost.com/wp-content/uploads/2015/02/DSCN1245.jpg)

The 755 page Estimates of National Expenditure sets out in detail what national departments plan to do and what their budget allocations are [Image: TBP]

Taxpayers will however still be compensated for fiscal drag as the tax bracket thresholds are increased. The higher tax rate will bring in a further R9.42 billion, but the fiscal drag relief will return R8.5 billion, so the net impact on tax payers is only an increase of R980 million. There will also be medical credits of R920 million, so the Treasury will only get R60 million extra from individual taxpayers.

Government spending will be cut by R25 billion over two years relative to the Budget 2014 expenditure proposals, but still rise by R107.6 billion this fiscal year to R1.351 trillion and by a further R97.8 billion to R1.4488 trillion in 2016/17, so economists warned the public should be wary of the loose use of the words “expenditure cuts”.

Pretoria resident Anonie Moletsane felt that the government would find it difficult to keep to its spending targets.

“I have two sons at the Tshwane University of Technology and they need certain equipment to further their studies. When they need that equipment I make a plan, even though it may not be in my budget and in that respect I do not think that the government is any different,” she said shortly after the Budget was released.

Barclays economists Miyelani Maluleke and Peter Worthington had some concerns about various aspects of the expenditure targets.

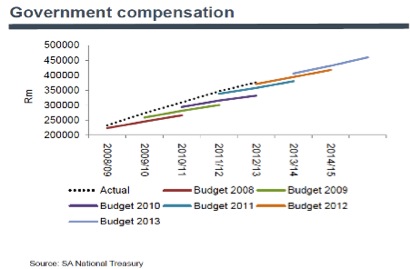

“The sharp fall in oil prices has brought inflation materially lower, allowing the government to postpone to a large degree its real expenditure consolidation. Adjusting the government’s nominal spending targets with the gross domestic product (GDP) deflator shows that real non-interest spending growth of 2.5 per cent is projected for 2015/16 – versus a previous promise by the government to limit growth to 2 per cent. Expenditure targets also have some upside risks, the first of which comes from the public sector wage negotiations underway to replace the current deal that expires at the end of March. A second area of upside fiscal risk is the contingent liabilities from state-owned enterprises,” they wrote.

Pretoria resident and an ex-employee of the Financial and Fiscal Commission Melinda Potgieter said research spendng should have been increased.

“I congratulate the Treasury official who thought of pulling that particular rabbit out of the hat. I worked on the employment tax incentive proposal and expected a greater emphasis on encouraging tourism, which is employment intensive and needs little electricity, but received only R1.8 billion or less than a twentieth of one per cent of GDP. I am disappointed that science and technology got only a R7.5 billion allocation, which is only one fifth of one percent of GDP. We should have research and development spending at 1.5 per cent of GDP, so that allocation should be increased eightfold,” she said.

Helen Suzman Foundation researcher Eythan Morris welcomed the budget given the slowing economic growth and power supply constraints.

“The Minister and the Treasury have done well under the circumstances. The Budget focuses on macroeconomic stability, including fiscal stability, and has a plan for keeping public debt manageable. The degree of growth policy coherence is substantial. We look forward to further support to growth from Treasury processes still under way,” he wrote.

South African Institute for Professional Accountants (SAIPA) tax expert Ettiene Retief, however, said the devil was in the detail as there was some bad news hiding in the fine print and the annexures.

South African Institute for Professional Accountants (SAIPA) tax expert Ettiene Retief, however, said the devil was in the detail as there was some bad news hiding in the fine print and the annexures.

Finance Minister Nhlanhla Nene granted tax relief to small businesses with those with an annual turnover of less than R1 million will see their company tax rate cut to 3 per cent from 6 per cent while those with a turnover of less than R335,000 will pay no tax. However this tax relief does not apply to small businesses that provide services as their core business, for example, accountants, engineers, graphic designers etc.

“For several years now, we have seen no tax breaks for small business owners who provide personal services, despite calls for incentives to be extended to them,” he wrote.

The personal services sector requires minimal electricity and has seen rapid growth worldwide.

“South Africa’s economy could benefit enormously if it were to extend the current small business tax relief and incentives to personal and professional services which have low start-up costs and provide the additional benefit of imparting much-needed skills to employees as they grow organically,” he concluded.

Helmo Preuss in Pretoria for The BRICS Post