Follow us on:

|

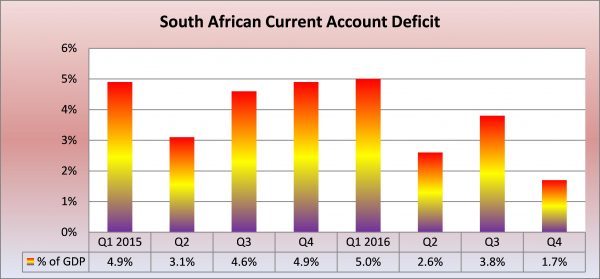

On annual basis, the current account deficit narrowed to 3.3 per cent of GDP in 2016 from 4.4 per cent in 2015

The South African current account deficit on the balance of payments narrowed to 5.1 per cent of gross domestic product (GDP) on a seasonally adjusted annualized basis in the fourth quarter 2016 from a revised 3.8 per cent (previously 4.1 per cent) in the third quarter 2016, the South African Reserve Bank (SARB) said in its latest Quarterly Bulletin.

The rand has weakened considerably over the past few years versus the US dollar as a current account deficit above 3 per cent is seen as unsustainable reaching a record worst level in January 2016 before recovering during the course of 2016.

At press time, the dollar had gained 1.02 per cent on Tuesday to reach 12.87 rand.

The consensus forecast of economists was for a narrowing in the current account deficit to 3.4 per cent in the fourth quarter based on the monthly foreign trade data.

On annual basis, the current account deficit narrowed to 3.3 per cent of GDP in 2016 from 4.4 per cent in 2015, 5.3 per cent in 2014 and 5.9 per cent in 2013. It was only 1.5 per cent in 2010.

A current account deficit implies that the country’s domestic production is unable to keep pace with domestic demand, so South Africa’s real GDP growth rate as measured from the production side has slipped from 3.3 per cent in 2011 to 2.2 per cent in 2013, 2.5 per cent in 2012, 1.7 per cent in 2014, 1.3 per cent in 2015 and 0.3 per cent in 2016.

South Africa as a small open economy has a large exposure to its foreign trade sector with exports of goods and services accounting for 30.3 per cent of GDP in 2016, while imports have a 30.2 per cent share of GDP. In the recession year of 2009, exports only accounted for 27.9 per cent of GDP, while imports had a 27.5 per cent share.

Helmo Preuss in Pretoria for The BRICS Post